Global & Local Bonds – 3rd Quarter September 2020

Global Bonds

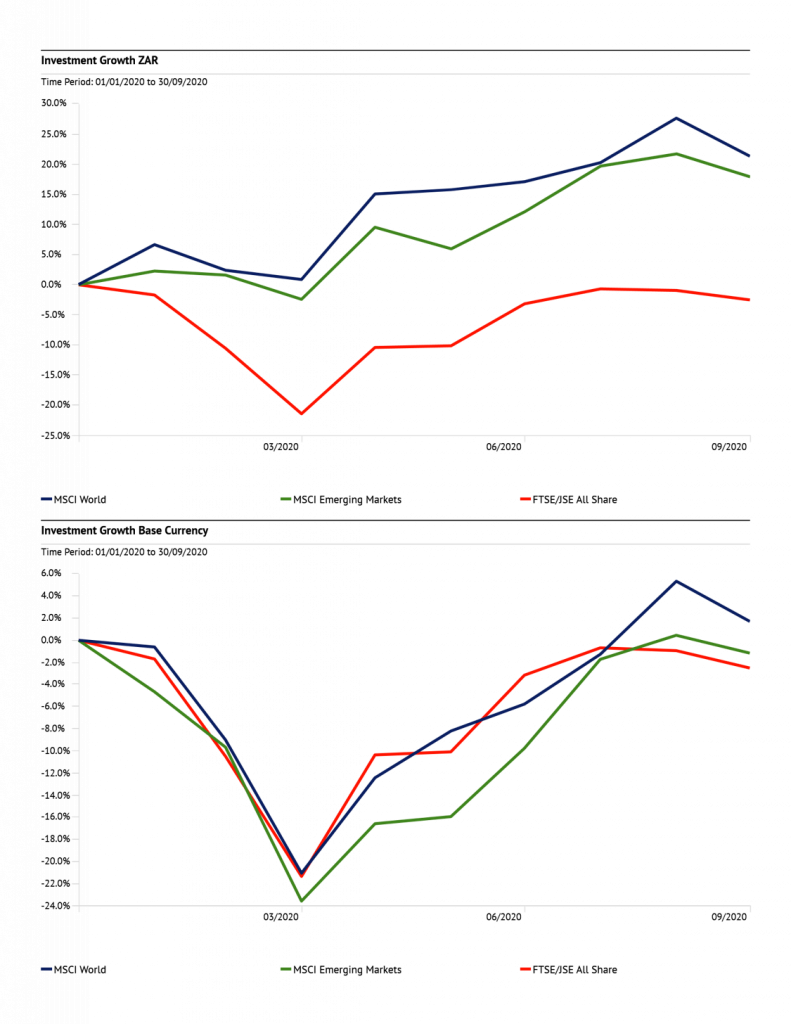

Global bonds were certainly risk on in markets over the quarter underpinned by the gradual reopening of global economies, hopes of a Covid-19 vaccine, as well as government economic policy measures. The Federal Reserve announced its change to its inflation targeting regime in August indicating it would target an average 2% inflation rate but allow for periods of overshoot. This was well received by markets. Corporate bonds enjoyed a positive quarter as riskier assets became more attractive and government monetary policy helped consolidate yields at lower levels.

Local Bonds

The Reserve Bank’s monetary policy committee left the benchmark interest rate unchanged at 3.5% even as it revised down its forecasts for growth in an economy still navigating its way through the fallout from the coronavirus shock. The Bank revised its GDP forecasts and is now expecting the economy to shrink -8.2% in 2020, compared to the -7.3% contraction forecast in July. It now expects the economy to grow by 3.9% in 2021 and by 2.6% in 2022. Plans to nationalise the SA Reserve Bank will be shelved as the government tries to get the coronavirus-stricken economy back on track.